In a new report, MobileAction examined how companies performed in leading storefronts, categories and regions during the first three quarters of 2022 to help app developers and marketers stay on top of the current state of Apple Search Ads and stay on top of the competitive market.

Side note: Apple Search Ads Report 2022: Hyper-Casual Games.

SearchAds.com Apple Search Ads Benchmark Report is built on the aggregate data of apps linked to SearchAds.com. In the MobileAction report covering January 2022 — September 2022, you’ll find a quarter-over-quarter analysis of key metrics by categories and storefronts and how they change compared to the previous year. Only categories with more than 45 apps are included in the MobileAction report to provide consistent and reliable data.

Here are the key metrics and formulas which MobileAction used to build this report:

- Apple Search Ads has once again proven to be one of the most profitable mobile ad platforms by having a 60%+ Conversion Rate for years in a row;

- The average Cost-Per Acquisition is on a downward trend as it was $2.50, $2.35, and $2.14 for Q1, Q2, and Q3, respectively;

- CPA for Australia increased by $0.69, making Australia the most expensive country with an average CPA of $3.83;

- The most significant increase in CPA happened in Canada, with an increase of $1.39;

- Apps that used Custom Product Pages converted users 4.75% higher than apps that didn’t;

- Sports apps had the highest CPT by $9.67 and, therefore, CPA by $15.05;

- Travel apps had the highest Tap-Through Rates and Conversion Rates for the second year in a row;

- The average CPT of Finance apps decreased by 70% in Q3 2022.

Key Metrics

Tap-Through Rate

Tap-Through Rate reflects the number of clicks on your ad divided by the total number of impressions. It can give you an idea of how relevant the paid keyword is to your app and how successful your ad creatives are.

Average SearchAds.com TTR for Apple Search Ads in the first three quarters of 2022 was 4.61%, down 36% from last year.

Here are the highlights of the year-over-year performance of SearchAds.com Apple Search Ads campaigns included in MobileAction report TTR by category:

- Travel apps had the highest TTR with an average of 11.26%, up 0.91%;

- Weather apps increased their TTR averages by almost 1% and ranked second;

- Photo & Video Editing apps experienced the biggest fall in TTR, down 3.27% from 8.39%;

- The biggest increase in TTR happened in Sports apps, up by 1.44%;

- Social Networking, Productivity, Weather, Business, and Travel Apps maintained their positions in the top 6.

Cost-Per Tap

Cost-Per Tap is the total ad spend divided by the total number of taps. It is a significant metric in Apple Search Ads as it’s the pricing model.

For the first three quarters of 2022, the average SearchAds.com Apple Search Ads search result campaign Cost-Per Tap was $1.45, up 25% from $1.16 for the same period last year.

Apple Search Ads campaign CPT performance by category was almost the same as last year.

- The average CPT in the first three quarters of 2022 was $1.45;

- Sports apps paid the highest price per click, with an average of $9.67;

- Finance apps retained second place but optimized their CPT averages, bringing it down to $3.60;

- News apps were the category with the lowest CPT average last year. However, they became the third-highest with an average of $3.45 in the first three quarters of 2022.

Among the Top 5 app categories:

- The Games and Health and Fitness categories were the only ones to experience increased CPT;

- While finance apps had an average CPT of $4.67 in H1 2022, they optimized it to $1.42 in Q3 2022;

- Social Networking and Food & Drink apps were the categories with the lowest CPTs, with an average of $1.02.

Cost-Per Acquisition

Cost-Per Acquisition reflects how much you pay per single download.

The average SearchAds.com campaign CPA in the first three quarters of 2022 was $2.33, up by $0.43 from last year’s first three quarters. However, it is downward as it was $2.50, $2.35, and $2.14, respectively, for Q1, Q2, and Q3.

With SearchAds.com, we were able to increase playtime by over 80% in the first 6 months of optimization. Thanks to automation rules, time savings, and smart tools, we have easily moved from using 20-50 keywords in most campaigns to using 50-200 keywords without worrying about bid and performance optimization.

Malte Kopke, marketing manager at Lite Games

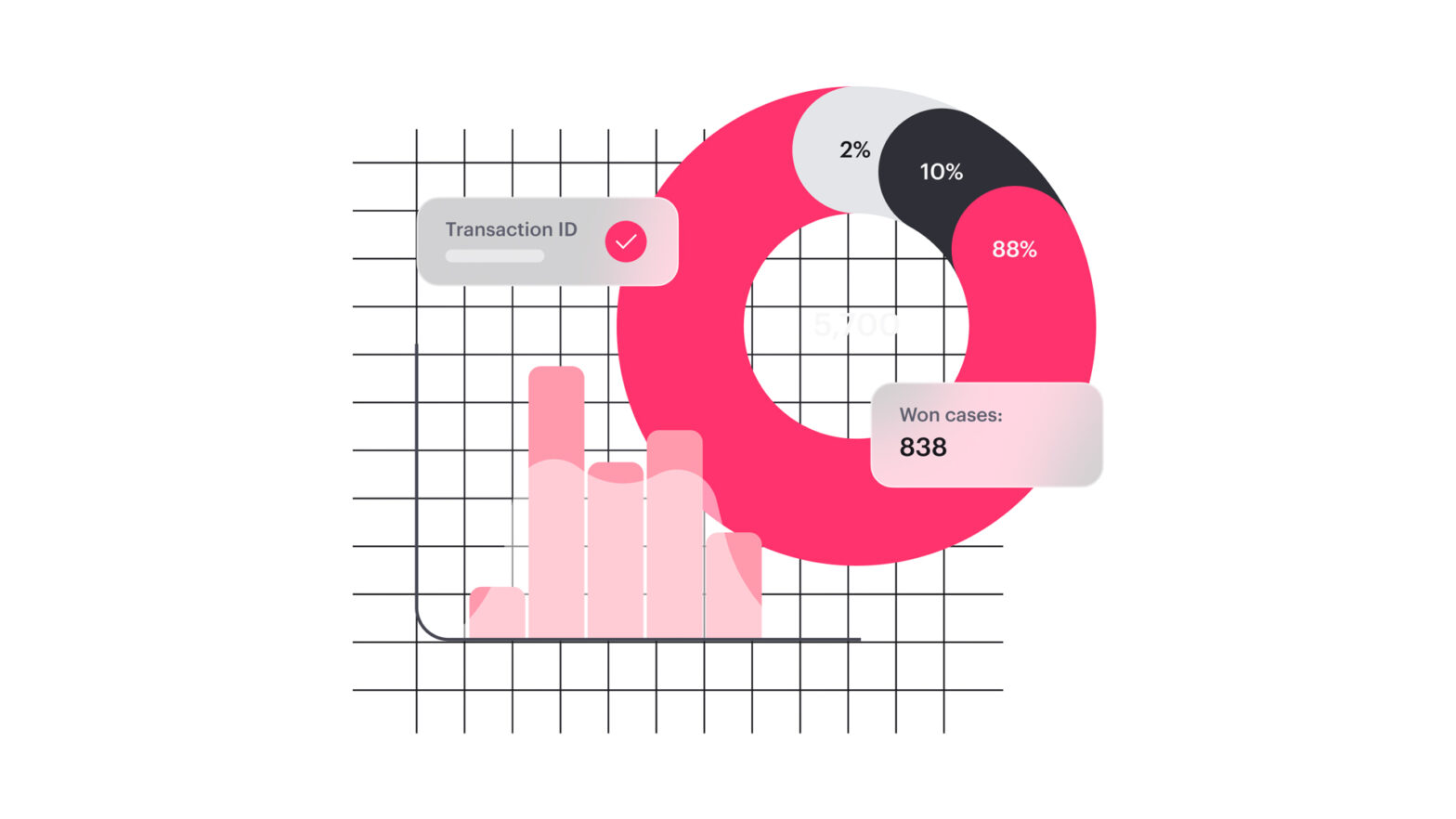

Custom Product Pages

At the beginning of 2022, Apple allowed app marketers to leverage custom product pages in Apple Search Ads to improve both the experience of users and app marketers. Now, app marketers can build up to 35 custom product pages to show different content, features, and promotions. On the other hand, users will now encounter more relevant content and creative assets when searching for an app.

MobileAction saw a 5x increase in the use of custom product pages and better results in key metric performances.

Below, you can see how key metrics performances have changed for apps that use custom product pages and apps that don’t.

Apps that used custom product pages:

- Got 4.75% better Conversion Rates and 0.73% better Tap-Through Rates;

- Spent 4% less per download and 2.5% per tap.

Read the full MobileAction report here.

2,673

2 minutes

2 minutes

2 minutes

2 minutes