Tenjin has released a new report focusing on trends and rankings on both the ad monetization, and the advertising side.

The landscape of the hyper-casual business has undergone significant changes, with profits not being as robust as they once were. There is a strong downward trend in ad revenue due to App Tracking Transparency (ATT) on iOS, changes in user-behavior post-COVID, and various other factors. Due to these changes, there is a transition of some hyper game developers to hybrid ones.

The goal of the report is to help smoothen the transition to hybrid by providing essential insights in the form of country and ad network rankings that cover both sides of the coin: advertising and monetization.

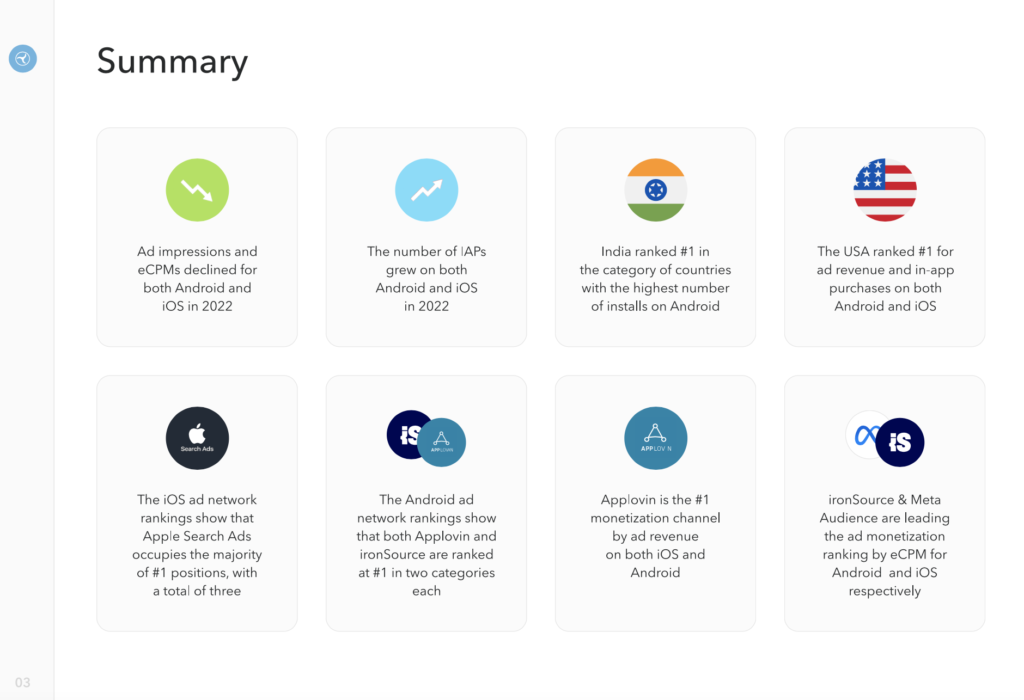

Here is a sneak-peak of some insights from the report:

- iOS: Ad impressions decreased by 20% throughout 2022

- Android: eCPM (revenue from 1000 ad impressions) decreased by 28% throughout 2022

- Android: # of in-app purchases (IAPs) increased by 37% throughout 2022

- India ranked #1 in the category of countries with the highest number of installs on Android

If you ask industry experts to define hybrid-casual, you’ll likely get a range of different answers. With no clear consensus on the new “hottest genre” or business model. What is clear, however, is that a hybrid storm is coming. Casual developers are integrating hyper-casual components and rewarded videos into their games, while hyper-casual developers are adding more in-app purchases and improving retention. But with advertising and monetization becoming increasingly difficult in 2023, developers will need to be strategic in their approach. We hope that these industry rankings and trends will help guide developers through this hybrid shift.

Roman Garbar, Marketing Director at Tenjin

Download the full report here.

1,129

1 minute

1 minute

2 minutes

2 minutes