IronSource has released two new reports on monetization and app search. In the monetization report, IronSource and Tapjoy found that Generation X makes in-app purchases «occasionally» or «often». This demographic prefers an ad-supported model to in-app purchases.

24% of survey participants use a one-time payment for ad removal, indicating the importance of monetization streams for user engagement.

78% of mobile gamers surveyed said they download free apps, and 52% download free apps with optional in-game purchases. They also surveyed users who don’t play as much and found similar spending habits — 76% and 46%, respectively.

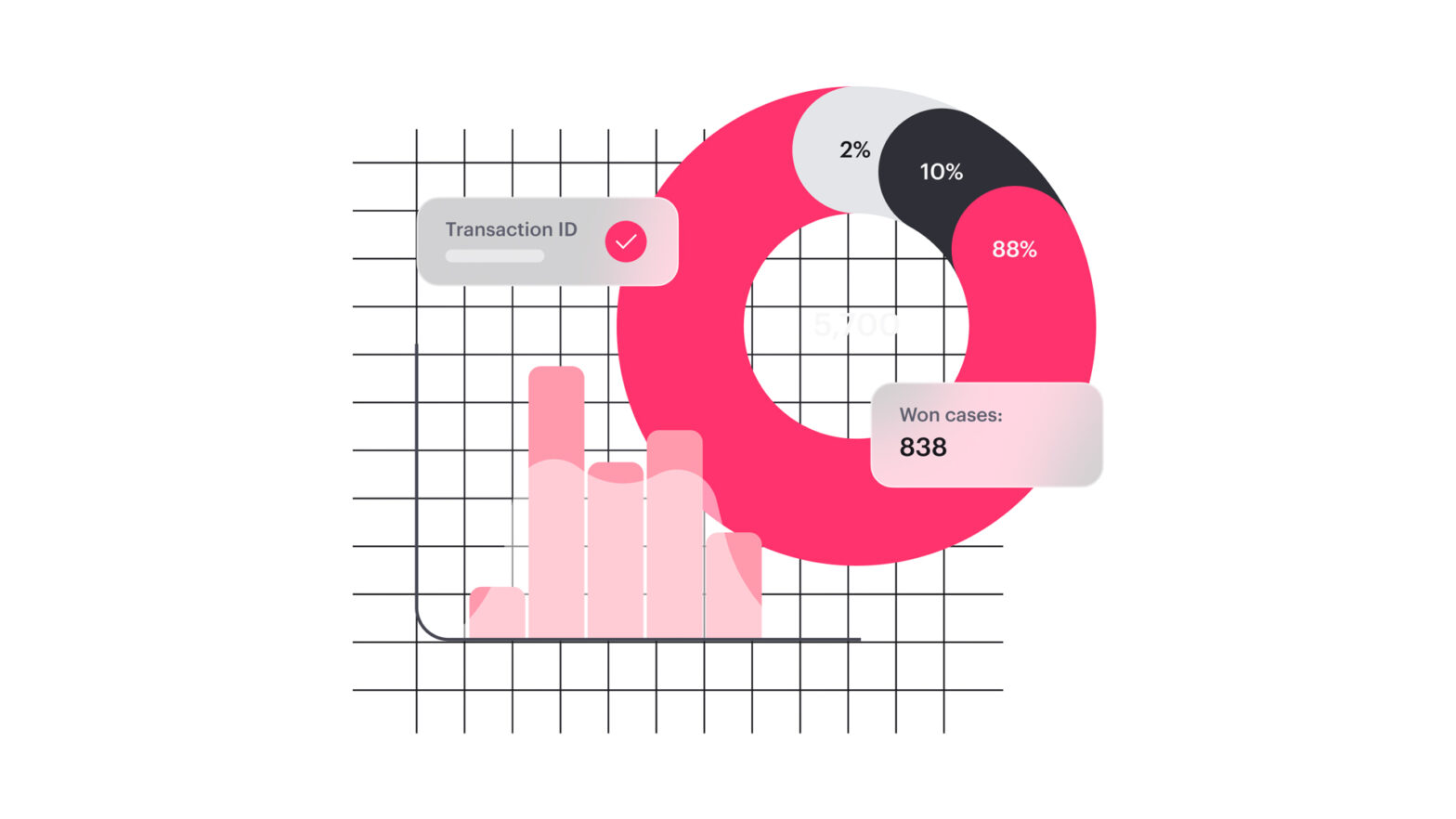

According to IronSource, Free-to-play dominates

The free-to-play market has grown over the past five years, with 43% of active gamers and 33% of passive gamers reporting that they download more free apps and fewer paid apps. However, 17% of enthusiastic gamers make more in-app purchases than 15% of passive gamers.

35% of active gamers reported not paying for apps, 20% were willing to spend up to $5 and 18% were willing to spend $1. Passive gamers are three per cent behind on each metric — 32%, 17% and 15%, respectively.

37% of active gamers sometimes make in-app purchases for a few dollars, compared to 28% of passive gamers. 16% of enthusiastic gamers buy bundles of $104 to $20, compared to 15% of the non-gaming audience, and 28% and 27%, respectively, do not make in-app purchases.

Finding apps

70% of gamers reported downloading apps after seeing ads on mobile devices, with most mobile gamers installing 20 or more apps. However, 39% to 50% use only five to ten apps daily.

IronSource reports that consumers rate interactive and in-store app ads as the most useful when searching for apps, proving that app selection and placement are vital factors in attracting users.

The latest report confirms what Tapjoy has been saying for years: mobile advertising plays a crucial role in app discovery for mobile games and other apps. The difference between those who play mobile games and those who use non-gaming apps is minimal in app discovery.

Jeff Drobik, head of US Sonic and Tapjoy at ironSource

32% of active gamers prefer app store ads such as Apple Search Ads (ASA), while 21% of non-gaming audiences prefer a combination of video ads and promotions.

The IronSource report found that rewards ads appealed more to users, with 36% of gaming audiences and 33% of non-gaming audiences paying more attention and dispelling the myth that rewards ads are only appropriate for gaming apps.

Social media apps proved to be the most popular among all demographic groups: 72% of gamers and 60% of non-gaming audiences use these apps daily.

Side note: Key KPI parameters during the recruitment campaign.

562

1 minute

1 minute

2 minutes

2 minutes